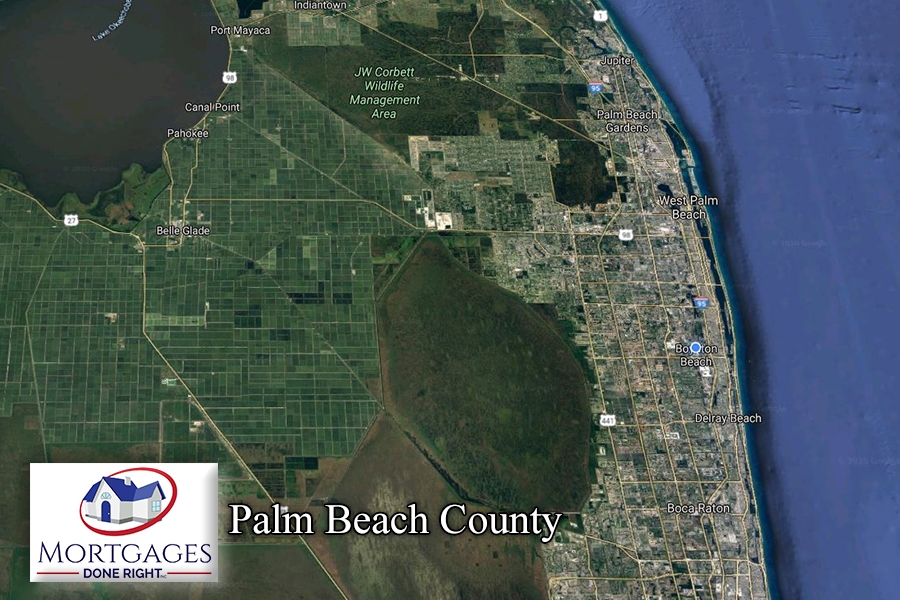

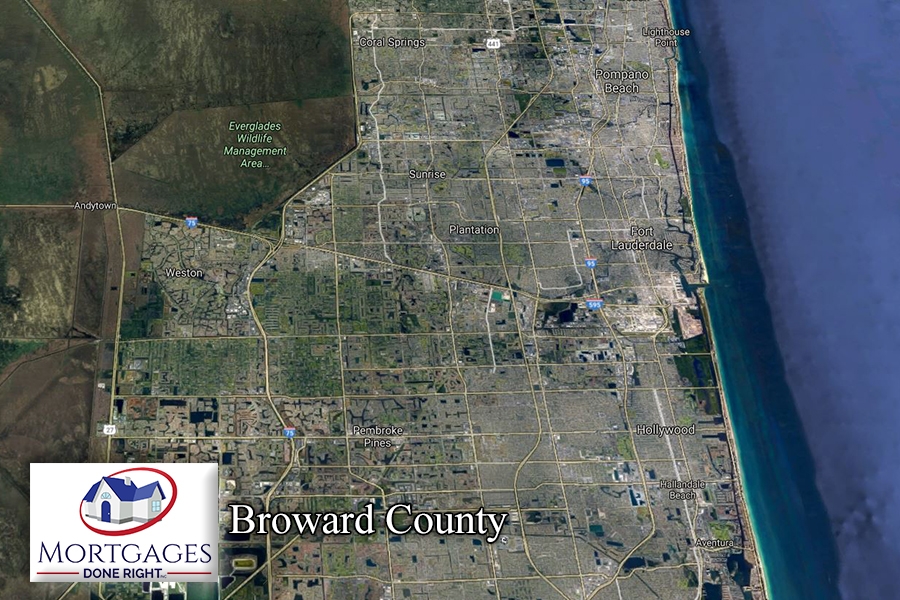

We currently service all of Florida for any of your Mortgages Needs. With over 30 years of experience and access to multiple banks we can find the product for you. But, we expecialize in the following 2 counties Palm Beach County & Broward County.

We know that every dream has a starting point. Purchasing a home can feel like a bunch of big decisions all at once, especially for a first-time homebuyer. Luckily, we work with homebuyers every day, answering all the big questions about homeownership, and we want to pass our 30+ years experience, knowledge and home-buying tips on to you.

Talk to one of our loan officers to ask anything and everything you want to know about the home-buying process. 561-777-7622

CLICK TO VIEW | Cities in Palm Beach County

South Bay

Golf

Manalapan

Briny Breezes

Greenacres

Mangonia Park

Hypoluxo

Highland Beach

Lake Clarke Shores

Belle Glades

Pahokee

Glen Ridge

Tequesta

Atlantis

Loxahatchee Groves

Palm Beach Shores

Haverhill

Gulf Stream

South Palm Beach

Cloud Lake

June Beach

Palm Springs

North Palm Beach

Wellington

Lake Park

Lantana

Palm Beach Gardens

Jupiter

Riviera Beach

Boynton Beach

Jupiter Inlet Colony

Ocean Ridge

Palm Beach

Royal Palm Beach

Boca Raton

West Palm Beach

Lake Worth

Delray Beach

CLICK TO VIEW | Cities in Broward County

Weston

Margate

Coral Springs

North Lauderdale

Tamarac

Pembroke Park

Plantation

Lazy Lake

Cooper City

Miramar

Parkland

Lauderdale Lakes

Sea Ranch Lakes

Coconut Creek

Pembroke Pines

Hillsboro Beach

Lighthouse Point

Pompano Beach

Deerfield Beach

Southwest Ranches

Sunrise

Davie

Hallandale beach

Lauderdale By The Sea

Dania Beach

Oakland Park

Lauderhill

Wilton Manors

Hollywood

Fort Lauderdale

8 steps to buying your first home

Get pre-approved for your mortgage

It’s important to find a loan officer who can get you preapproved for your budgeted amount. You can then begin your search for your dream home knowing what you can afford. Sellers like buyers who are preapproved.

Though the process is pretty straightforward, it does require that you gather documents such as identifications, bank statements, plus income and asset statements.

Make an offer on the right house

Once your research and Realtor have helped identify the home that’s just right for you, it’s time to put your preapproval to work; it’s time to make an official offer. Don’t worry, it’s a nervous time for everyone. Take a deep breath, trust your instincts and enjoy the moment.

Get the home appraised

The lender ultimately needs to determine if the house you’re buying is worth the price you’re paying. To do this, they perform an appraisal of the property to evaluate if the home’s value matches (or exceeds) the amount of the loan.

If it doesn’t, then you’ll need to talk to your loan officer about your options.

Sign the papers to close the sale

Assuming the appraisal is favorable, then you’re just a few signatures away from making this house your home. These documents will legally bind you and the seller to the terms, as well as initiate the transferring of funds that makes your first-time homebuyer loan official. Congrats!